Whether you are an established business or just getting started, insufficient cash flow can cripple your operations and growth. Many institutions may not view your company’s invoices for what they are, an asset!

What is Invoice Factoring?

Invoice Factoring is a transaction in which a business leverages its invoices to a third party commercial finance company, like Capital Business Finance. When factoring with Capital Business Finance, we will advance up to 90% of the amount of your outstanding invoices. After initial funding, you will receive working capital within 24 hours of us receiving an invoice. We do not impose limits on your monthly receivables, so this process can be repeated as often as you produce an invoice. Factoring is very beneficial to companies whose clients pay on terms. Instead of waiting 30, or even 60, days for your clients to pay, factoring allows you to free up cash flow to use for such things as making payroll or growing your business.

Factoring is not a loan, so no debt is added to your balance sheet and the funds are unrestricted, so you have the flexibility to use them how you wish. Unlike traditional lenders, we are not concerned with your credit history. Instead we will look at the credit worthiness of your customer, who owes on the invoice. Capital Business Finance will also provide back-office support and handle your collections, even for invoices you are not choosing to factor.

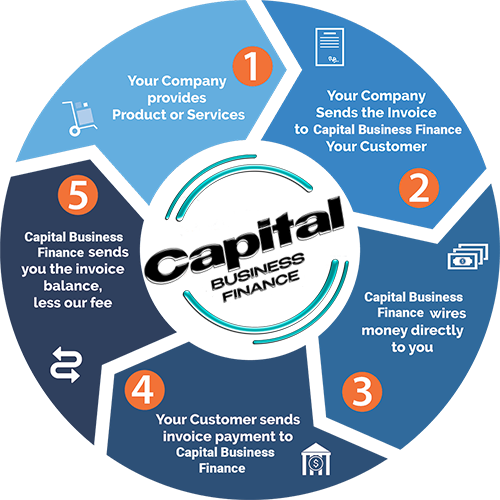

How does Factoring work?

Once a product/service is completed, you generate an invoice to both your client and Capital Business Finance. We then verify the submitted invoice and advance you up to 90% of the total invoice value. Capital Business Finance is concerned with the credit quality of your clients (account debtors) and not your personal or business credit scores. After the invoice is submitted, working capital will arrive in your bank account within 24 hours. Once your client has sent payment when the invoice is due, Capital Business Finance will remit the balance back to you, less our fee. We can repeat this process as often as you generate an invoice.

Get the cash you need today.

The Factoring Process

- You provide products or services to another creditworthy business on terms.

- You send the invoice to your customer and send the invoice, along with any support documentation (i.e. purchase orders, contracts, etc.), to Capital Business Finance.

- Capital Business Finance will verify the invoice then advance a portion of the invoice directly to you, typically 70 to 90 percent.

- Your customer then pays the invoice by ACH, wire transfer, or a check made out to your company, but sent Capital Business Finance address.

- Capital Business Finance then sends you the invoice balance, less our fee. We can repeat this process as often as you generate an invoice

Capital Business Finance Advantage

- Same day approval/closing in 2-5 days

- Working capital is sent within 24 hours of receiving invoice

- No more worry about making payroll

- Deal directly with decision makers

- No maximums for monthly receivables

- No debt is added to your balance sheet

- Challenged credit is a non-issue

- Years in business is not a factor

- Assigned account team for your company

- No equity required, keep 100% ownership of your business

- Save time and money with a third party handling day-to-day accounts receivable