What is Accounts Receivable Financing?

Whether you are an established business or just getting started, insufficient cash flow can cripple your operations and growth capabilities. Traditional institutions often do not view your company’s Accounts Receivable for what they are, an asset! Capital Business Finance does not see through the eyes of traditional lending institutions and can turn your Accounts Receivable into working capital. This takes away the concern of making payroll, paying vendors/suppliers, and securing growth capital. Your only concern should be producing a product or performing a service, not having to chase clients to meet everyday expenses. Let Capital Business Finance turn your Accounts Receivable into a Line of Credit by using your invoices as collateral.

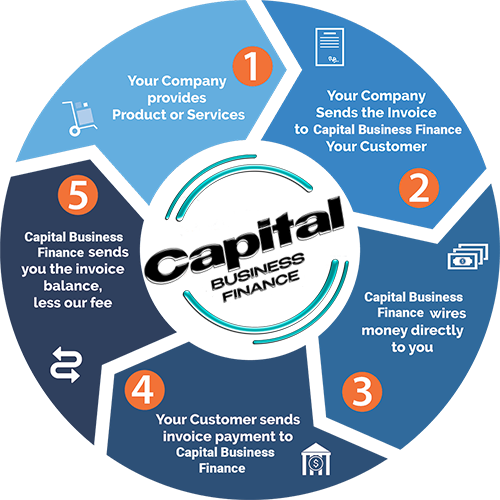

How does Accounts Receivable Financing work?

Once you generate an invoice, Capital Business Finance goes to work for you. We begin by verifying the submitted invoice(s) and advancing up to 90% of the total value of the invoice(s). Capital Business Finance is concerned with the credit quality of your clients (account debtors) and not your personal or business credit scores. Working capital will arrive in your bank account within 24 hours. Once your client has sent payment for the invoice(s), Capital Business Finance will charge a financing fee and remit the balance back to you. We can repeat this process as often as you can generate an invoice.

Get the cash you need today.

- You provide products or services to another creditworthy business on terms.

- You send the invoice to your customer and send the invoice, along with any support documentation (i.e. purchase orders, contracts, etc.), to You send the invoice to your customer and send the invoice, along with any support documentation (i.e. purchase orders, contracts, etc.), to Capital Business Finance.

- Capital Business Finance will verify the invoice then advance a portion of the invoice directly to you, typically 70% to 90%.

- Your customer then pays the invoice by ACH, wire transfer, or a check made out to your company, but sent Capital Business Finance address.

- Capital Business Finance then sends you the invoice balance, less our fee. We can repeat this process as often as you generate an invoice.

Capital Business Finance Advantage

- Same day approval/closing in 2-5 days

- Working capital is sent within 24 hours of receiving invoice

- Deal directly with decision makers

- No maximums for monthly receivables

- No debt is added to your balance sheet

- Challenged credit is a non-issue

- Years in business is not a factor

- Assigned account team for your company

- No equity required, keep 100% ownership of your business

- Save time and money with a third party handling day-to-day accounts receivable

Our Clients’ Testimonials

What to Expect with Accounts Receivable Financing

When funding your invoices with Capital Business Finance, you will be assigned a personal account manager who will handle collections, payment processing, and customer credit approvals, allowing you to focus on your business. With Accounts Receivable Financing, we look at the credit history of your customer, not your company or personal credit history.

Years in business is not a factor in our decision to finance, making AR Financing great for start-ups. Once established with Capital Business Finance, you will receive same-day funding on submitted invoices. This gives you access to unlimited working capital, right when you need it. Receivables Financing also allows you to extend longer payment terms to clients and grow your business.