Capital Business Finance provides asset-based lending, accounts receivable financing, and equipment leasing to businesses in need of working capital. Our bank referral program obtains funding for your client in an efficient and timely manner. If your client is unable to meet the qualifications for bank financing, we can provide an alternative source of lending, so they never have to be turned down or hear the word ‘no’.

Our funding process offers your client a custom financing solution, with focus on their business’s financial growth and stability. Capital Business Finance acts as an intermediate stepping stone to build your client’s business portfolio, until they are financially able to return to you for bank financing.

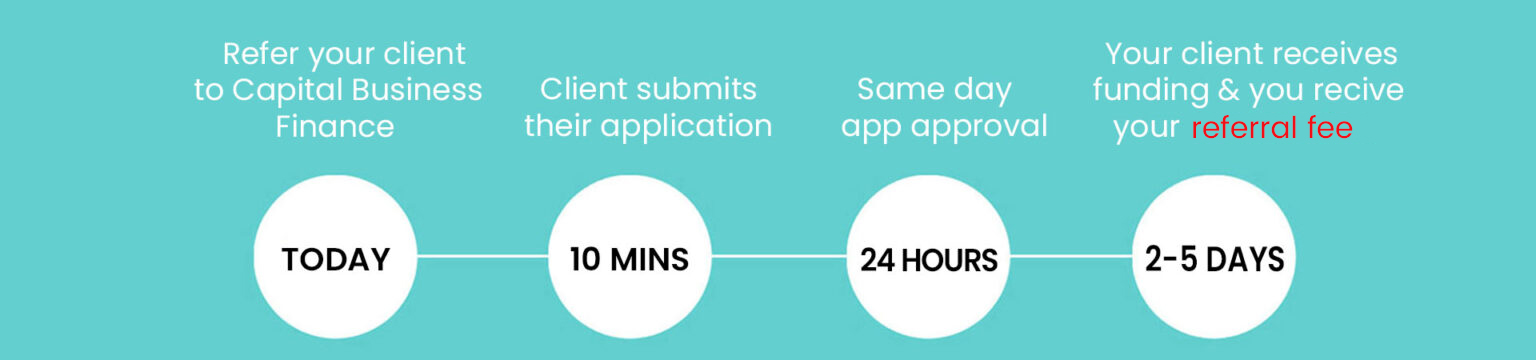

Capital Business Finance has developed a bank referral process that obtains funding for your client in an efficient and timely manner. Our four step process offers your client a custom financing solution to ensure their company’s growth.

Step 1 – Refer Your Client to Capital Business Finance

You can refer a client to Capital Business Finance by submitting our short client referral form below or by sharing our contact info for your client to contact us directly.

Step 2 – Your Client Submits Their Application

After referral, we will connect with your client for a brief introductory meeting and send along our one page application. They will then return the application to us, along with any supporting documents that are needed.

Step 3 – Same Day Application Approval

With Capital Business Finance, you and your client deal directly with decision makers. Once we receive your client’s submitted application, we issue an approval decision within 24 hours. Once approved, our underwriting team goes to work in order to provide timely Finance for your client. During this step, we have an open line of communication with your client to ensure we are all on the same page, so we can provide the most beneficial solution for their company.

Step 4 – Your Client Receives Finance

We are able to provide a fast solution for your client, with finance in just 2-5 days. After initial finance , all additional funding is available within 24 hours. We don’t just stop our process once finance is completed. Your client will also be paired with a Capital Business Finance account manager, who is on call at all times to answer any funding questions and aid them in their company’s growth.

A Typical Capital Business Finance Client:

- Sells products or services to other businesses or government

- Is anywhere in the US

- Needs a financing facility from $50,000 to $10 million

- Has commercial accounts receivable

- Often has collateral, such as accounts receivable, purchase orders, or equipment

- May be in rapid growth mode

- May be marginally profitable or losing money

- May have a weak balance sheet

- Could be in, or emerging from bankruptcy

- May have a challenged credit history

- Might have tax liens

- Is unable to obtain bank financing or has maxed out their bank line of credit

- Might be in an asset recovery department of a bank or on an “exit” strategy

- Preferably needs to refinance quickly

- Wants to establish a relationship with a knowledgeable and flexible lender

The Capital Business Finance Advantage:

- Fast response time with same day approval and closing in 2-5 days

- Custom solutions available with our diverse product mix

- Deal directly with decision makers

- Optional referral partner updates every step of the finance process

- Years in business and number of employees are not deciding factors

- Proven track record for assisting in top line growth

- Flexibility for clients with a limited or challenged credit history

- No maximums for our clients’ monthly receivables

- Capital Business Finance is a direct source of capital, we close, fund, and service your clients

- No equity required

- Our company is built on relationship and trust